Prior Pay

Description of Prior Pay

Prior Pay is a mobile application developed by Priorbank, designed for contactless payments using smartphones equipped with NFC (Near Field Communication) technology. This application is available for the Android platform and allows users to make transactions conveniently and securely. Prior Pay eliminates the need for physical cards, streamlining the payment process for users who wish to make purchases with just a tap of their smartphone.

To start using Prior Pay, individuals must first register within the app. The registration process requires users to provide their mobile phone number, along with the details of an existing Visa debit or credit card, including the full card number, expiration date, and CVV2 code. Additionally, users must create a name for their card, which will be displayed in the application for easier identification. Once the registration is complete, users receive a one-time code via SMS to confirm their registration, followed by the creation of a password for future logins.

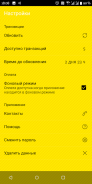

The app's interface is user-friendly, allowing for easy navigation between various features. Users can manage multiple cards within the application, providing flexibility and convenience for those who utilize different payment methods. Prior Pay supports a range of Visa cards, including Visa Classic, Visa Gold, Visa Platinum, and Visa Infinite, ensuring that many users can benefit from its functionality.

For making payments, users need to ensure that their smartphone's NFC feature is activated. Once activated, they can simply inform the cashier that they intend to pay using a contactless method. Upon launching the app and logging in, users select the card they wish to use for the transaction and position their smartphone near the payment terminal. The app provides immediate feedback on the transaction status, notifying users when a payment has been successfully processed.

Security is a priority for Prior Pay, which mandates the use of a smartphone lock, such as a password, pattern, or biometric authentication. This ensures that only authorized users can access the application, safeguarding sensitive financial information. Additionally, the app requires the “Phone” permission for optimal functionality and does not operate on devices with "root" or "developer" modes enabled, enhancing its security measures.

Prior Pay also emphasizes the importance of having a reliable internet connection for registration and transaction processing. Users must have a valid SIM card in their smartphones, as the application does not function without one. This requirement ensures that users can receive necessary notifications and updates related to their transactions.

The application is designed for those who prefer a cashless lifestyle, offering a modern solution for everyday purchases. With the rise of digital payments, Prior Pay caters to the growing demand for efficient and secure transaction methods. This is particularly beneficial in retail environments where contactless payments are increasingly accepted.

Furthermore, the app provides users with the ability to track their spending and manage their finances more effectively. Users can view transaction histories, helping them stay organized and informed about their expenditures. This feature supports personal finance management by offering insights into spending habits.

Prior Pay’s design accommodates users with varying levels of technological proficiency. The straightforward setup process, along with its intuitive interface, makes it accessible for both tech-savvy individuals and those who may be less familiar with mobile payment applications. This inclusivity broadens the app's potential user base, allowing more people to take advantage of its features.

For users who frequently shop at establishments that accept contactless payments, Prior Pay represents a practical tool that streamlines their purchasing experience. The ability to carry out transactions without the physical presence of a card simplifies the payment process, reducing the time spent at checkout.

In addition to its primary function of facilitating payments, Prior Pay contributes to the broader trend of digital banking solutions. It aligns with advancements in financial technology, providing users with a contemporary means to manage their finances securely and efficiently.

By integrating various features, Prior Pay stands out as a reliable application for those looking to adopt a more modern approach to payments. With its emphasis on security, user-friendliness, and effective management of payment methods, it serves as a valuable resource for individuals who prioritize convenience in their financial transactions.

In summary, Prior Pay offers a comprehensive solution for contactless payments, ensuring that users can engage in transactions with ease and security. Its features cater to a diverse audience, making it a significant player in the landscape of mobile payment applications.